Share Buybacks and Game Theory

During their Investor Day, Flutter ($FLUT) , the parent of Fanduel, announced in their 8-K a $5 billion share buyback program, and the share price jumped in pre-market trading. Here’s the fun part, DraftKing’s ($DKNG) pre-market share price also jumped.

In their premarket announcement, Flutter also raised their Total Addressable Market estimates in the US and their respective performance metric guidance.

But this is not a study/blog on guidance. No, this is a blog about game theory strategies.

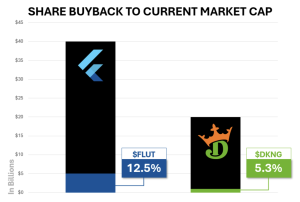

First, are all buybacks equal? Short answer, no. Here is an approximation of announced buyback amount relative to current market cap.

Generally, buyback % is directly related to sentiment/confidence. The higher the former, the higher the latter.

I know, I know. These buybacks are to be stretched out over X time so the denominators in the calculation are not exact. We could go down a rabbit hole of forecasting market cap over the period of buyback given the updated guidance, but someone mentioned this was not a blog post about guidance, so we won’t.

Aside from the percentages, timing is of interest.

Draftkings announced their share buyback in an 8-K as part of their earnings “print”. We covered this announcement in a previous blog post:

DKNG Earnings: The One Big Thing No One Is Talking About…

DKNG Earnings: The One Big Thing No One Is Talking About…

Flutter does not report earnings until mid November, so this announcement came as part of their Investor Day.

Someone very wise once said “bad news early, good news on time” and I have never heard any saying about “good news early,…” Will keep an ear open.

Business is often considered an “infinite game”. In order for that designation to be true (i.e. there is no predetermined end point) two criteria should be met:

- It can go on forever; or

- Until one player quits

These types of games are less about “winning” and more about “cooperation” because they have to be. In these games, when the game ends is not known so survival is succeeding.

Tit for tat, or copy cat, is a popular and flexible strategy in game theory if the game is considered “infinite”. Each “player” mirrors the action of their opponent. It involves rewarding cooperation and punishing defection. Here is our share buyback example:

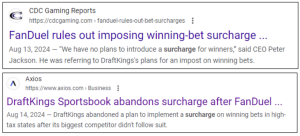

Grim trigger is a more severe strategy, as the name would suggest. Cooperation by each player exists until one player defects. Once one player defects, the other player defects forever. Though it does aim to deter defection, because of its finality once triggered, it also creates mutual certainty of destruction. Here is a micro example of such:

DraftKings attempts to defect by introducing a surcharge and Flutter defects permanently forcing DraftKings to cooperate with the defection.

It is possible both strategies are being played in certain instances but that a third strategy is being employed by both at a macro level. “Win-stay, lose-shift” is all about cooperation unless the payoff is low relative to expectation. The goal of this strategy is to learn and adapt from the outcomes. It can earn high payoffs but can get stuck in suboptimal outcomes.

Like all games, there is no one right strategy for every player. It can depend on the rules of the game, preference or outcome preference for the players, and each player’s “patience” or discount factor. Are they impatient and want their outcome today? Or are they willing to sacrifice for longer term relationships and outcomes.

Needless to say, fun to watch, but more fun to play.

More from SharpRank…

Click here to read this week’s SCALER.

Click here to read our latest blog post: Rates, Odds, Money Supply, and Jerome Powell