DKNG Earnings: The One Big Thing No One Is Talking About…

Last week Draftkings, Inc. (DKNG) reported the quarterly earnings. For the most part, bulls and bears saw/heard exactly what they needed to reaffirm their stances. Revenue beat, CY adjusted EBITDA guidance cut, reaffirm 2025 adjusted EBITDA guidance, etc.

The biggest news came from the proposed tax pass through to the consumers in the form of a surcharge, in states where the tax rate is above 20%. There has rightly been plenty of coverage on this but it will not be the focus of this report. Eilers and Krejcik modeled out the surcharge revenue opportunity for DKNG, setting a preliminary value at around $270 million.

But, that is what everyone’s talking about. The hot topic. What no one seems to be talking about. More specifically, talking about in depth enough is the $1 billion share buyback authorization.

Share buybacks by a company are generally created for one of two reasons:

- Last ditch effort to save the investor from fleeing

- Bullish intermediate or long term sentiment/outlook from management

Regardless of the “why”, each requires a strong enough balance sheet and in this case, DKNG could buy back roughly 6% of the company from the public. So which one is it? The former or the latter?

In the release, the CFO refers to it as “… inaugural share repurchase authorization”. Inaugural is defined as meaning the beginning or the start of a series, suggesting this could be the start of share repurchase programs. Word choice is important in public company prints. Just ask the A.I. in charge of “decoding” Chairman Powell’s comments on federal rate cuts. But so are actions. Largely, just announcing suggests #1, executing on that announcement suggests #2.

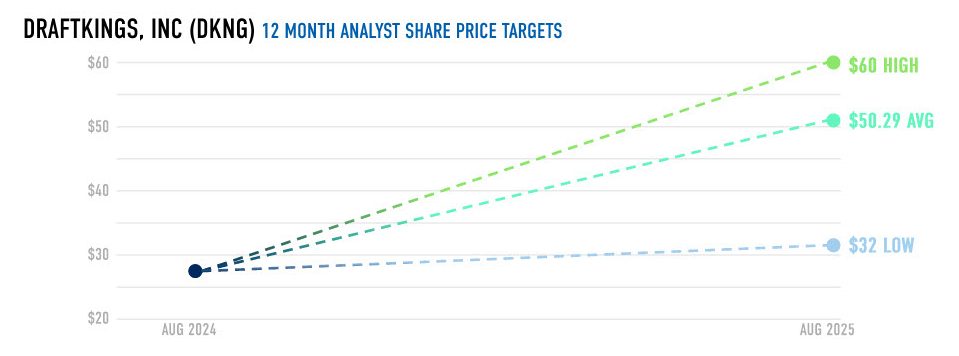

According to TipRanks, twelve month analyst price targets, many reiterated or assigned after earnings, show the following:

Of these analysts, the buy/sell ratings are showing:

But this only validates, after the fact, the central point of this post. This buyback program was years in the making. It also came in far above expectations. Most stakeholders (analysts, shareholders, etc.) predicted and modeled a share buyback coming in the range of $100 – 500 million. This is the earnings print beat no one is talking about.

It is widely understood, that share buybacks, if stemming from #2 above, is an above board, totally legal and more upstanding cousin to insider trading. The unknown to the public/shareholder is known to those approving such a repurchase program. This is one reason why, despite the bearish evidence in certain areas of the earnings, the analysts reiterated their ratings and price targets.

This will stop short of technical analysis but a few key items worth mentioning; current support and resistance levels:

The timing of the announcement may indicate management sees value at the price as it bounces around near the short and intermediate support levels. Notice also the 200 simple moving average of $38.90 sitting close to the resistance levels. Recent channeling patterns show more down than up and there is a broken handle on the cup and handle pattern. There are also some gaps to fill above the short term support still but that’s where the technical look will stop for purposes of this post.

A word or two for the wary, over the next few months this buyback, if deployed, as the ability to “put the stock price”. If done in a slow, calculated manner by management it will likely anchor additional “support”. Purchasing that many shares, should they do so, will take some effort to hide because the buying will need to be done in blocks that are significant to its current/historical volume. That said, if deployed, it will not likely be done on the open market…

The release also adds the normal disclaimer that DKNG does not have to do anything and can cancel it at any time. Additionally, the history and guidance of dilution through stock based compensation suggests that actions will be important. Keep an eye out for SEC filings for completion of such buyback.

Other notable firms, given the macro environment, have chosen to go long on cash, which would run counter to a share buyback program, if DKNG does deploy it. So for the Draftkings inaugural share repurchase program is it #1 or #2? Like everything, it depends.

This is not financial advice, nor is it intended to take an opinion on the matter, it is simply pointing to an area no one seems to be looking at deeply enough.

If you enjoyed this and want more thorough fundamental and/or technical analyses, reach out!

More from SharpRank…

Click here to read this week’s SCALER.

Click here to read last week’s blog post: The Power of Pressure.