NFL & Private Equity Investment in Teams

With a meeting on August 27th to discuss and possibly vote on the issue of private equity ownership of NFL franchises, here’s a quick exercise to demonstrate why this is on the table for NFL owners…

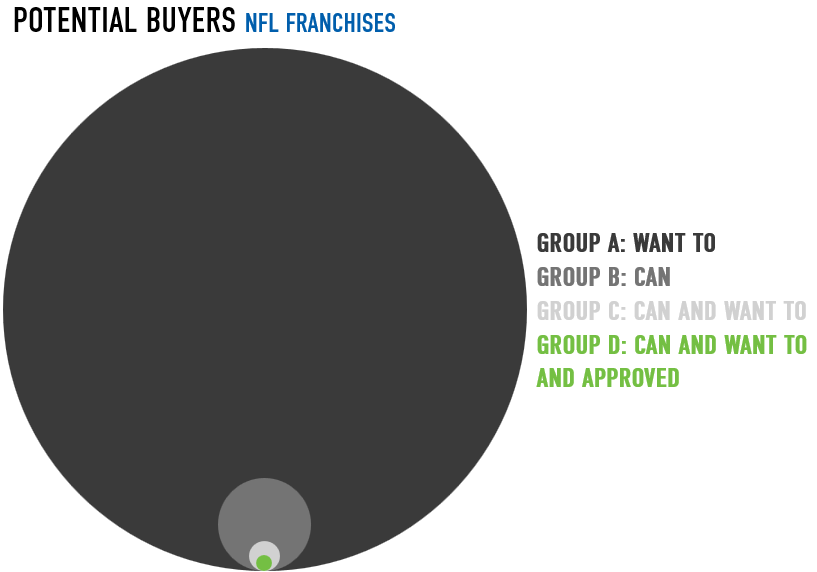

Raise your hand if you WANT to buy an NFL team.

Great. Hands down.

Now raise your hand if you CAN buy an NFL team.

Welcome to the perfect storm of fair market value for NFL franchises and their owners. To understand this, let’s look at the definition and criteria of fair market value. Put simply, fair market value is a transaction between a willing buyer and a willing seller.

Some of the other criteria include: Both buyer and seller are reasonably knowledgeable about the asset, buyer and seller are behaving in their own best interests, both parties are free of undue pressure, and each is given a reasonable period for completing the transaction.

Now from the little exercise above what was learned? There are plenty of people who WANT to buy into an NFL franchise (Group A) but there are very few people who CAN (Group B) and there are even fewer who CAN and WANT to (Group C). There are even fewer people who CAN and WANT to and would be approved by other owners and the League (Group D).

Fortunately, there is not a lot of turnover and a limited pool of potential acquisitions. But that does not change the likelihood of outcome on fair market value sales when the system could be anti-competitive.

Here’s the dilemma, what happens if the limited pool of buyers doesn’t want to buy the team for sale. In other words is not “willing”. The owner/seller currently only has a few choices:

- Drop the price (subject to other restrictions) to open up the pool of potential willing buyers

- Pass it down (subject to inheritance tax and other restrictions) provided whoever is receiving still fits in Group D from above

- Do nothing

Conversely if one applicant emerges as an interested party, the team owner’s options limit even further because dropping the price is no longer an option. The potential buyer holds the leverage and is likely to say “well, looks like I’m the only one who said yes to ‘going to the dance’ with you, so it’ll be on my terms or you’re on your own”.

But Why Now?

Why does it feel like private equity ownership in NFL franchises is suddenly about to be voted on, seemingly out of nowhere? Truth be told it isn’t as sudden as the consumer may think. Much like gambling adoption and global expansion of the game (i.e. foreign games) which seemed like sudden adoption, the private equity model in conjunction with NFL ownership has been in the works for over a decade. And for good reason:

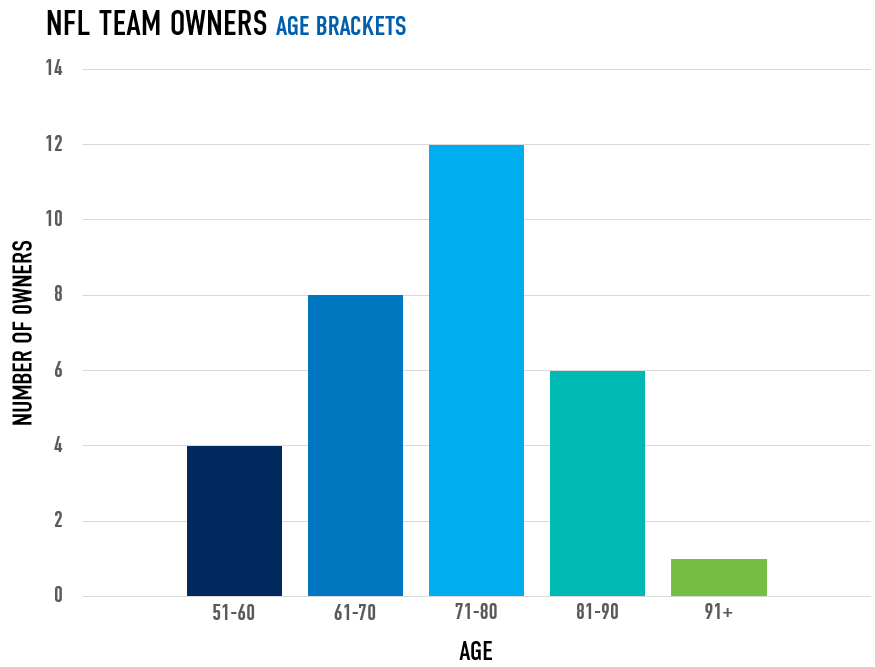

Only thirty-one team owners are listed here. Green Bay was excluded because of its shareholder ownership structure.

As valuations, on paper, have skyrocketed in recent years and the demographic of the owners has aged, the pool of Group D, from above, has become proportionally smaller.

Liquidity Is Important

The NFL owners (the sellers) need to be able to find someone to buy and have largely become victims of their own success. Enter private equity.

For some context and because size matters, the private equity’s conservative assets under management (AUM) estimates range from $5-13 trillion. The highest concentration of these private equity funds? You guessed it, the United States. Compare that to the high end NFL franchise valuation of around $10 billion looking for somewhere between 5-10% ownership allowance for select private equity groups and bingo, a match made in heaven.

An overly simple math example. An NFL franchise worth $10 billion could sell a 10% stake to private equity. The owner would retain majority ownership but be able to take home $1 billion.

Without liquidity, it’s really just a piece of paper and a made up valuation number.

It’s Never That Simple

Valuation methodologies and investment criteria/theses will need some adjustment by the potential new pool of private equity buyers. Traditionally, these private equity groups value companies based on, among other things, EBITDA (earnings before interest, tax, depreciation, amortization) multiples.

Unfortunately, an NFL franchise cannot really be valued this way because expenses are almost entirely owner discretionary. Traditionally, franchises are valued off a revenue multiple, a market comparable analysis, or both.

There’s Also That Other Thing…

Private equity is numbers. It is calculated. And it is, above all else, efficient. They are the best at what they do and their allegiance is to quantifiable metrics like free cash flow, profitability, valuation, etc. Their allegiance is not directly to the fan who has gone to every game for 20 years. Some struggling fan bases may say, “well neither is my do nothing owner!”, but again keep the size, scale, and magnitude of an NFL franchise vs. AUM of private equity in mind.

This means, if ticket prices need to go up or down, they will. If salaries need to go down, they will. If the team needs to move, it will. If cable providers no longer provide the same value as streaming services, they will be gone. If the team needs a new coach, it will get one. If the hot dogs are too expensive, the cost will get slashed or the price will go up.

Who Cares About 5-10% Ownership?

How much influence can a minority owner really have in a company/team? That’s a discussion for a different day. The point here is, like other leagues before it, should this private equity initiative be adopted, the landscape of NFL ownership will shift dramatically.

Click here for a link to one of the recent stories.

More from SharpRank…

Click here to read this week’s SCALER.

Click here to read last week’s blog post: DKNG EARNINGS. The One Thing No One Is Talking About